Report: Good research, bad funding for Canadian cleantech ventures

A new report suggests that Canada’s competitiveness on the global stage is being threatened by its lacklustre ability to fund high-potential cleantech startups.

The report was written by Cycle Capital Management, Sustainable Development Technology Canada and Écotech Québec. The three organizations are hoping their report can change minds about the sector they contribute to.

Authored by Gilles Duruflé and Louis Carbonneau, the report found that Canada lags competitors in the strength of its clean technology investment chain.

“Forging a Cleaner and More Innovative Economy in Canada” found that while Canada has failed to compete in commercialization and providing adequate venture capital and debt financing. This all despite being known as a cleantech research leader.

“There is intense global competition in the cleantech arena as nations strive to capitalize on the environmental, economic and social benefits derived from cleantech innovation. Given the significant investment in this area, we wanted to find out where Canadian cleantech may have an advantage,” wrote Leah Lawrence, CEO of Sustainable Development Technology Canada.

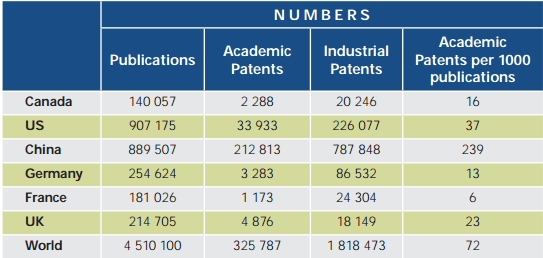

Canada, wrote the authors, failed to compete in commercializing that research into market-ready technologies, as measured by the number of filed cleantech patents.

The study’s sponsors urged action to make Canada’s cleantech sector more competitive on a global scale.

“Discussions are ongoing to define Canada’s action plan for climate change and developing a strong Canadian cleantech sector is definitely part of the solution. Considering our expertise, we wanted to provide as much data and facts as possible to better understand how to shift to a greener economy by building competitive cleantech companies with…Canadian ownership,” wrote Andrée-Lise Méthot, Founder and Managing Partner of Cycle Capital Management.

The study particularly tried to show how Canada has lagged behind the United States on a per capita basis in both venture capital and debt financing, both critical components in helping companies innovate, scale up their operations and commercialize their technologies.

While this isn’t a new idea, it’s perhaps a strong reminder from yet another industry within Canadian tech that says it needs more assistance to grow.

You must be logged in to post a comment.

+ There are no comments

Add yours