Portag3 Ventures Announces New $300M FinTech Fund in Montreal During FinTech Forum

Speaking during a lunch session at this year’s FinTech Forum in Montreal, Paul Desmarais III announced that Portag3 Ventures has established a new fintech fund, Fund II. As of today, the fund has closed $198M, and expects that number will rise to $300M according to this morning’s press release. While speaking to the crowd, Desmarais suggested that number could be more like $400M when all is said and done making it “significantly larger” that the first fund.

“$60 billion has been invested into FinTech over the past year” Desmarais told the audience during his lunchtime presentation. He later added that Canada has $4.4 trillion in investable assets, 80% of which is held by the big 5 banks. He believes that Portag3 is well positioned to cultivate fintechs all over the world because of its ability to connect talent, capital and network, pointing repeatedly to investments they have made in Greece, France and elsewhere, on top of their Canadian success stories like WealthSimple. Desmarais explained, he looks at the entrepreneur first when making investments. “We look at disruptors and enablers wherever they may be in the world”.

Power financial, IGM and GreatWest Lifeco are the principal investors in the new fund, with other backers including National Bank, Intact, Equitable Bank, La Capital and a handful of others.

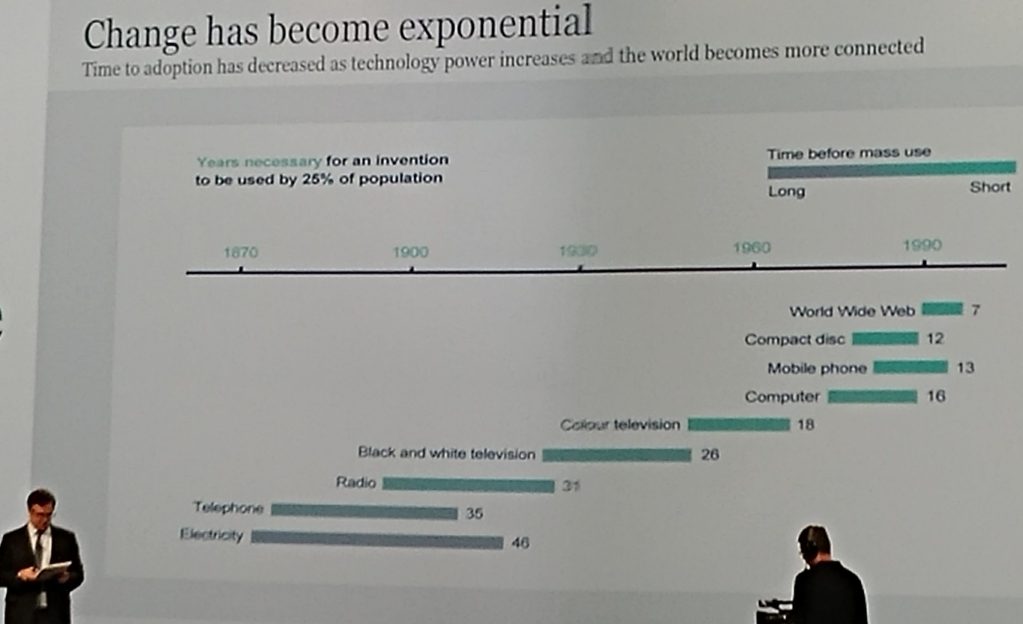

Desmarais also explained why he is such a believer in FinTech, telling the crowd he believes that banks have a difficult time providing a great customer experience because they offer products that are “good enough for everyone”, which essentially makes them perfect for no one. Following that thinking, he went on to say that fintechs who tackle 1 problem at a time provide a glimpse into the future of the financial industry in Canada, explaining that financial institutions will likely have little choice but to begin selling hyper-segmented products, like a fintech does. He expects this will begin to provide a superior customer experience. As he showed during his presentation (see photo) the pace at which people adopt new technologies has accelerated greatly. A trend he expects will continue and one that could potentially play right into the hands of large scale fintech investors.

5 Comments

Add yours+ Leave a Comment

You must be logged in to post a comment.

It’s going to be finish of mine day, except before end

I am reading this impressive post to increase my experience.

I’ve been exploring for a little bit for any high quality articles or blog posts on this kind of area .

Exploring in Yahoo I at last stumbled upon this website.

Studying this info So i’m happy to show that I’ve an incredibly just

right uncanny feeling I came upon exactly what I needed.

I such a lot surely will make certain to do not forget this website and provides it a

glance on a constant basis.

I don’t even understand how I ended up here, however I assumed this post was great.

I don’t recognize who you’re but certainly you are going to a famous

blogger in the event you aren’t already. Cheers!

This site was… how do you say it? Relevant!!

Finally I have found something which helped me.

Thanks a lot!

Hiya! I know this is kinda off topic however , I’d figured I’d

ask. Would you be interested in trading links or maybe

guest writing a blog post or vice-versa? My blog covers a lot of the same subjects as yours and I believe we could greatly benefit from each other.

If you might be interested feel free to shoot me

an email. I look forward to hearing from you!

Excellent blog by the way!