Montreal tops Toronto, startups raise $2.5 billion during year

Montreal’s venture capital activity is growing and industry watchdogs are noticing.

And while loosely thrown-around phrases like “top startup destination” should almost always be taken with a grain of salt, a new report from Reuters may be the closest thing to proof that Montreal and Canada as a whole are, in fact, rising.

Montreal rose five places to take over the 11th strongest venture capital city spot in North America according to the new report that detailed venture capital activity on the continent over the first nine months of 2016.

According to the report, $736 million was invested within Montreal compared to $645 million in Toronto. Toronto traded spots with Austin to reach the number 13 spot while Vancouver and Kitchener-Waterloo landed at 20th and 21st place respectively. Unsurprisingly, San Francisco led all metro regions with 15.98 billion invested.

The numbers in 2015 in Canada easily surpassed those from last year after three quarters, noted Geektime. An “explosive” $2.5 billion in activity is the best result the country’s startups have seen in 15 years. The numbers already top $2.3 billion in all of 2015 according to a report by CVCA (Canadian Venture Capital and Private Equity Association).

“This represented the best first nine months of any calendar year since 2001, while the number of deals done was the most since 2005,” wrote Reuters.

Montreal’s contributions to some of the bigger deals in Canada this year included Dalcor Pharmaceuticals ($126.7 million), Triotech Amusement ($80 million) and Blockstream ($75.8 million).

READ ALSO: Austin Hill out as Blockstream CEO amid front office shake-up

Still, Canada’s $774 million in deals over the nine months was far below the $10.6 billion seen in the US. Canada’s average deal size of $5.6 million average was high for Canada, but it lagged behind the US ($17.7 million), UK ($16.9 million), and Israel ($15.3 million).

That average also pulled Canada “out of its traditional last-place ranking among the top 10 VC-attracting nations,” noted Reuters. Thankfully (sigh) that honour now goes to France!

Interestingly, investment by Canadian funds in non-Canadian companies also had a strong showing in the first nine months, with just over $362 million invested in 67 deals.

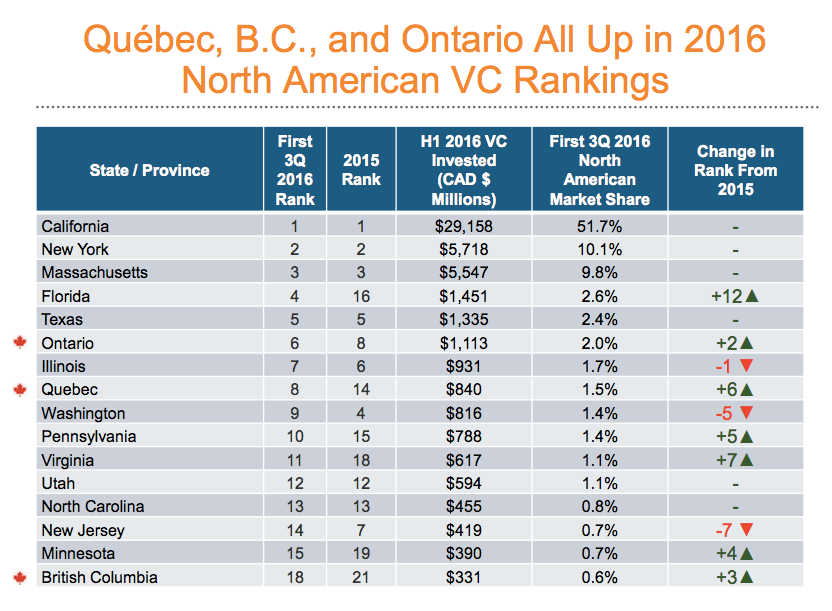

Despite Montreal’s improved stature within Canada, Ontario still topped Quebec when it came to the deals. Ontario, Quebec, and British Columbia all rose in their North American rankings by state and province, to 6th , 8th , and 18th place, respectively.

Real Ventures took the role of the most active private independent Canadian investor investing in Canadian companies, partaking in 50 deals for an estimated value of $22.2 million. Montreal-based Anges Quebec and Cycle Capital took second and third spot with 28 and 21 deals, respectively, worth about $10 million each.

You must be logged in to post a comment.

+ There are no comments

Add yours