Today in tech funding: Workjam | dcbel | Mako Fintech

Digital workplace Workjam raises $44 million

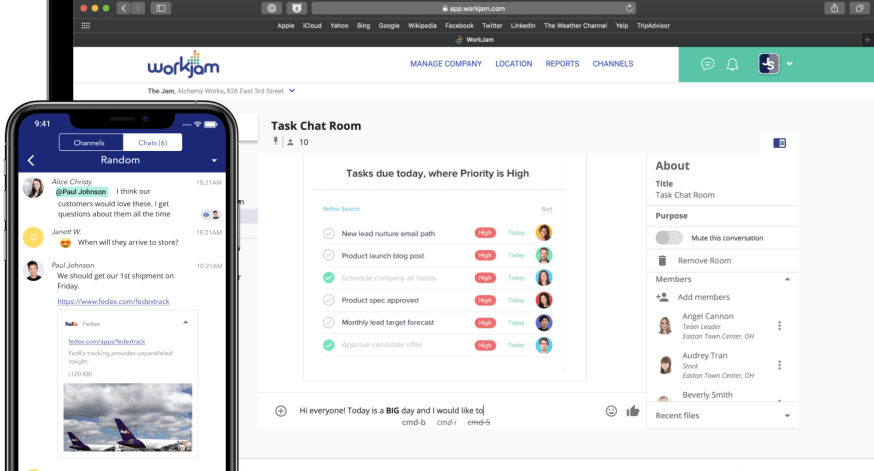

WorkJam, a Montreal-based digital workplace for frontline workers, is raising $44 million (US $35 million).

VentureBeat reports the funding is coming from Silver Lake Waterman. Companies like Kroger, Shell, and Target use WorkJam’s technology to engage with frontline workers.

Founded in 2014, the company serves as a communication conduit that allows headquarters to liaise with those working out in the field, from health care professionals and manufacturing personnel to grocery delivery drivers and anyone not tethered to a physical desk.

At its core, WorkJam is setting out to improve “productivity and employee retention,” WorkJam CEO Steven Kramer told VentureBeat’s Paul Sawers.

“WorkJam enables companies to use the labor they have more efficiently,” he told the website. “When frontline employees feel more connected to and heard by their employer, it fosters engagement. When employees feel like they have opportunities to find extra shifts, take training to increase their skillset and value, be recognized for good work — all of these things add up to a more engaged employee that is more motivated and satisfied with their work.”

WorkJam previously raised US $62 million, most of which came through a series C round last April. With this new funding, the company is well positioned to cater to the estimated 80 percent of workers — some 2.7 billion people globally — who don’t work from a desk.

dcbel takes $9.4 million non-dilutive loan from Silicon Valley Bank

Montreal electric vehicle charging station company dcbel is announcing a new a $9.4 million (US $7.5 million) non-dilutive loan from Silicon Valley Bank. The cash comes as dcbel wants to bolster manufacturing and meet demand for its r16 intelligent home charger. This is in addition to a US $40 million funding round announced in April of this year. dcbel is committed to helping families reshape their relationship with renewable energy and decarbonize the power grid by scaling production of the r16.

dcbel says it will begin manufacturing the r16 intelligent home charger in Québec, with additional US & EU manufacturing capabilities to be announced in 2022. The new dcbel r16 units will be available for sale in California, New York, and Texas this fall.

“We are excited to work with a financial partner like Silicon Valley Bank who understands the needs of a fast-growing company,” said dcbel’s Matthieu Vidricaire. “This will help us introduce our first manufactured product under challenging conditions in the global supply chain.’’

“With their launch of innovative products like the r16, dcbel aims to provide homeowners with exceptional solutions for the management of their home, car and solar energy systems,” said SVB’s director of technology, Graeme Millen. “We’re excited to provide this credit facility in support of dcbel’s continued growth and to help meet increasing customer demand.”

Mako Fintech gets $2 million from Desjardins Capital

Mako Fintech, a financial technology platform that automates wealth management processes, announced today it has raised a $2 million seed round.

The cash is coming via Desjardins Capital, with participation from a group of angel investors, including current and former CEOs and other senior executives at several financial institutions.

“There are significant advantages from bringing on an investment from a financial institution like Desjardins Capital,” said Mako Fintech’s Raphael Bouskila. “It’s not only bringing us the resources we need to serve our growing client base, but it’s also a heavyweight vote of confidence with other players in our ecosystem.”

Mako’s mission is to “democratize the digitalization of wealth management” by providing firms with an automation solution adapted to its workflow processes. They say their offering costs a fraction of the cost of enterprise players who are developing similar solutions for financial institutions. They do that through advanced low-code workflow automation systems.

The company will use the money to hire additions to its team and support customer demands, product development and growth initiatives.

Bouskila sold his last company, CoPower, to VanCity bank in 2019. CoPower was an impact investment platform. The founder says his new company “understands that each firm deserves to have its own tailored automation solution, in order to provide its clients with the best experience and service possible.”

The impact of the COVID-19 pandemic has permanently changed the way that wealth managers interact with advisors and investors, creating an urgent need for cloud-based, remote-friendly solutions. Mid-market and enterprise wealth management firms are seeking automated and efficient operations and Mako Fintech says they can tailor solutions.

“By investing in Mako Fintech, Desjardins Capital is pursuing its mission of supporting SMEs in their growth ambitions,” said Desjardins Capital’s COO, Marie-Hélène Nolet. “The solution offered by Mako Fintech responds to a growing need of wealth managers to take a digital turn, and the last 18 months have confirmed it.”

You must be logged in to post a comment.

+ There are no comments

Add yours