Bain Capital invests in Custom Factory Equipment Manufacturing Platform Vention

Vention is announcing a $17M CAD Series A financing round led by Bain Capital Ventures. This marks the first time the venture arm of Bain Capital will write a cheque into a Montreal company. The funding will accelerate the development of Vention’s cloud-based MachineBuilder 3D software, and expand its modular hardware library.

Bain Capital Ventures joins Vention’s previous investors White Star Capital, Bolt, and Real Ventures. Ajay Agarwal, Bain Capital Venture’s managing partner, will be joining Vention’s board. Ajay Agarwal is recognized as a prolific investor, twice named to the Forbes Midas List of Top 100 Venture Capital Investors, and as an operator helped scale revenues to $300 million at Trilogy, a software company out of Austin, Texas focused on developing software for Global 1000 companies.

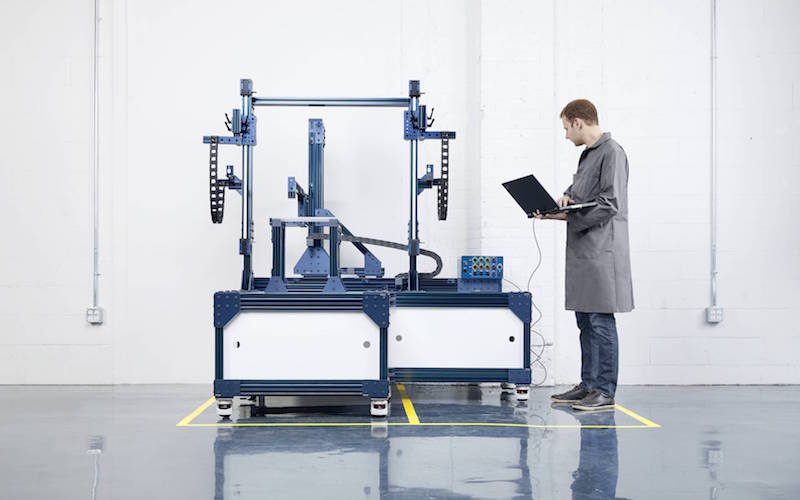

Vention has radically changed the way companies design and order custom equipment for their operations. Traditional design-to-build workflows for custom equipment take anywhere from one to six months, depending on the project’s complexity. Vention’s modular components and easy-to-use cloud platform enable those same workflows to be completed in as little as three days, including shipping (which is offered next-day throughout North America).

Above: Vention machine builder interface

Vention’s new platform release focuses on the user experience, integrating hundreds of new features such as smart part connections, comprehensive design collaboration tools, and a learning algorithm that predicts the next parts needed in a design. It also includes 200 new modular and machine components that cover a broad array of use cases in automated equipment, robot cells, tooling, and conveyors applications.

Vention continues its rapid growth trajectory with 600% year-over-year growth. The company

currently serves several hundred clients and thousands of users in a variety of industries, including robotics,

aerospace, and automobiles. Vention is also the first and only combined software and hardware platform

certified by Universal Robots, and it maintains partnerships with Thomson Industries, Interroll, and

PolyAlto.

Above: Vention management team

“Building a large-scale industrial business takes a special breed of investor. We are excited to partner with Bain Capital Ventures, which has a long track record in our industry,” said Étienne Lacroix, Vention’s founder and CEO. “Working with Bain Capital Ventures also means we’re bringing an investor on board with a deep understanding of our manufacturing clients’ needs”.

On behalf of Bain Capital Ventures, Managing Partner, Ajay Agarwal said “As an active investor in robotics and automation, we’ve witnessed the convergence of collaborative robotics, increasing automation, and a growing need for speed and agility in today’s modern manufacturing world.” That’s what makes this investment such a great fit, according to Agarwal. “Etienne and his team have developed a simple and flexible product that’s being adopted at a rapid clip. The company couldn’t be in a stronger position to seize an enormous market opportunity, and we’re excited to help Vention become a leader in the industrial equipment category.” Ajay Agarwal also told MTLinTECH “we have been spending more time in Canada lately and are excited by the technology companies we’re seeing there, and we look forward to making more commitments to the ecosystem.”

About Vention.io

Vention is a next-generation digital manufacturing platform for machine design, enabling engineers and other manufacturing professionals to design, order and assemble custom factory equipment in just a few days. Vention’s AI-enabled, cloud-based MachineBuilder 3DTM integrates a comprehensive library of modular parts for applications such as automated equipment, robot cells, tooling, and conveyors. The

company was founded in 2016 and is headquartered in Montreal, Canada.

For more information, visit: www.vention.io

About Bain Capital Ventures

Bain Capital Ventures partners with disruptive founders to accelerate their ideas to market. The firm invests from seed to growth in startups driving transformation across industries, from security and cloud infrastructure to logistics and e-commerce to finance and healthcare. The firm has helped launch and commercialize more than 240 companies, including DocuSign, Jet.com, Kiva Systems, LinkedIn, Rapid7, Rent the Runway, SendGrid, SurveyMonkey, Taleo, TellApart and Turbonomic. Bain Capital Ventures has $4.9 billion in assets under management with offices in San Francisco, New York, Boston and Palo Alto.

For more information, visit: www.baincapitalventures.com

5 Comments

Add yours+ Leave a Comment

You must be logged in to post a comment.

Write more, thats all I have to say. Literally, it seems as though you relied on the video to make your point.

You definitely know what youre talking about, why throw away your intelligence on just posting videos to your blog when you could be giving us something informative to read?

I’m gone to tell my little brother, that he should also pay a quick visit

this webpage on regular basis to obtain updated from hottest gossip.

Howdy! Quick question that’s totally off topic.

Do you know how to make your site mobile friendly? My site looks weird

when browsing from my iphone 4. I’m trying to find a template or plugin that

might be able to resolve this problem. If you have any suggestions,

please share. Appreciate it!

I’m impressed, I must say. Seldom do I come across a

blog that’s both educative and interesting, and let me tell you,

you have hit the nail on the head. The problem is something which too few men and women are speaking intelligently about.

I’m very happy I stumbled across this in my

search for something concerning this.

Saved as a favorite, I like your site!